Life begins BEFORE 40, for sure!

On 16th March, 2017, I turned 39. I give thanks and praise to God! Yet barely 24 hours prior I was a little discouraged. No, not a midlife crisis 🙂 My disappointment came from discovering a negative CAD 4,839.01 hole in my ministry account. I’ll tell you why.

THANK YOU FOR 38TH

All thanks and praise to God, last year around my 38th birthday we launched a campaign to raise $10,000 between March and June for all the Lausanne Movement assignments thrust upon me in 2016. And guess what? WE DID IT! Thanks to people like you, we raised slightly more than the $10k target and I was not only able to fulfill all the Lord’s tasks in Europe (Czech Republic), North America (US/Canada), Africa (Ghana), Asia (Indonesia), and Latin America (Panama) but was even able to do a couple of these missions with my dear wife and partner for life, Anyele. Thank you! Thank you! Thank you! The seeds sown from those initiatives are still blossoming and bearing fruits.

AND NOW…

As I enter my 40th year of life this week I’m already thinking LEGACY—how you and I will be remembered after we’re long gone. How will our lives continue on, even though we are dead? Martin Luther King Jnr. died at 39, at my age today, shot in the jaw while readying himself to lead one of his characteristic civil rights marches. What if Luther King had said, “Life begins at 40?” His short life but long legacy is still celebrated today, decades later, all over the world.

For a 40th year legacy project, my aim is to raise CAD 40,000 ($4,000 for every decade of my life) over the next 24 months, from 16th March 2017 to 15th March 2019 for what I believe is the greatest legacy you and I can ever leave: godly, effectual global servant-leaders deeply transformed to transform nations and generations. This means raising only CAD 1,667 each month for the next 2 years. Will you contribute to the President’s Scholarship for Global Leadership?

One of my favourite leaders, Peter Scazzero, author of The Emotionally Healthy Leader, puts this task bluntly: “We must train the next generation for leadership. The world population is now 7.2 billion people. It will be 8.5 billion in 2030 and 9.7 billion people by 2050. Think about that: We will add 2.5 BILLION people in the next 33 years! Who will be the apostles, prophets, pastors, teachers and evangelists to equip these additional 2.5 billion people?” And to think that even today there are 3.5 billion people in our world still to be transformed with the Gospel of Jesus Christ! Each of us will need to reevaluate our lives and adjust our “wineskins and priorities to meet this acute need.” WHO will you contribute to this task?

STARTING WITH ME

I am offering the ‘second half’ of my life as a living sacrifice to God and you for this task. Half of this CAD 40,000 will be an investment in Yaw Perbi towards academic rigour, deeper spiritual formation and reflective praxis so I may ‘reproduce after my kind’ for the task unfinished.

It has been nine years since surviving that fateful accident in Cote d’Ivoire (above) after which I felt the Lord calling me to fully devote my life to preaching the gospel and raising younger leaders. And “I was not disobedient to the heavenly vision.” Thus far, there has been no formal academic training in theology, missiology or leadership. There surely has been a lot of on-the-job learning and doing from a place of clear calling, vision and pure passion. It is now time for critical reflection of self and praxis, solid biblical theological training to undergird my call and academic rigour to complement what is already natural and supernatural about this calling.

AM I WORTH THIS INVESTMENT?

So, a few months ago I took the plunge and was accepted into the prestigious Fuller Seminary’s Master of Arts in Global Leadership. Having been pouring and pouring into others, it was refreshing to put together a comprehensive Learning Plan for myself. It has been a rich soul-searching experience for one who is more of a doer than a reflector. My transformation is affecting everything about me including slowing down for loving union with Jesus and leading out of the strength of my marriage. The organisations I lead are on the path of deeper discipleship and emotionally healthy leadership as a result.

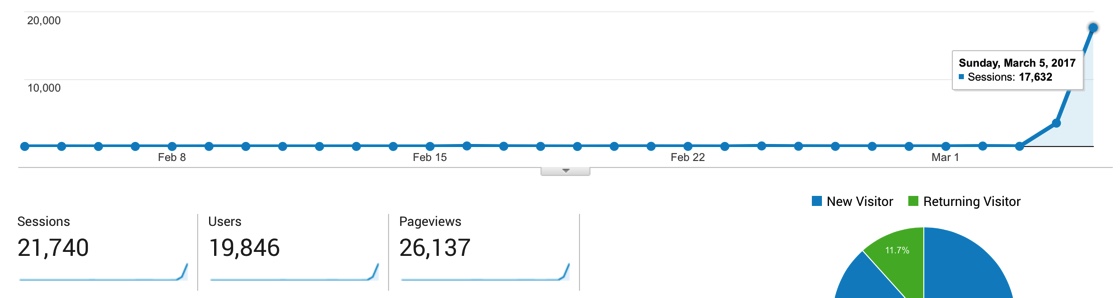

And you know an investment in Yaw Perbi affects tens of thousands more. Only last week, a reflection I did on “When Life Doesn’t Make Sense” based on some of my MAGL learning so far reached over 30,000 people on FaceBook and over 26,000 hits on my personal website! You decide; if investing $20,000 in me is worth it or not. With the aforementioned example alone, that’s less than $1 investment per person impacted!

QUALITY EDUCATION IS COSTLY

Fuller is no doubt ‘the Harvard of seminaries,’ with a 70-year record of producing great leaders of our time like Rick Warren. With 4,000 students enrolled online and on 7 campuses from 90 countries and 110 denominations, Fuller is the largest multidenominational seminary in the world!

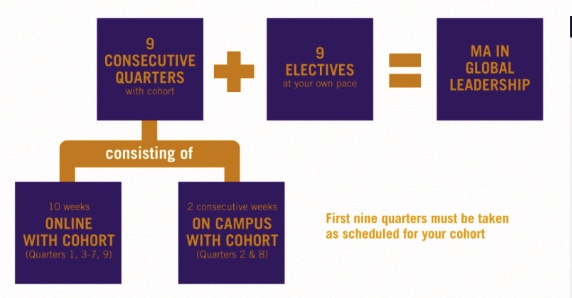

A course at Fuller costs USD 1,200; it isn’t cheap. I have negotiated a deal for ISMC so that any of our staff could get a 30% discount, bringing this amount to USD 840. Unfortunately, the drop of the Canadian dollar to the US dollar by about 30% sends us back to paying nearly the same USD 1,200 still. The MAGL consists of 9 core courses taken in sequence with the rest of my cohort from around the world and 9 electives, resulting in a total of USD 15,120 or CAD 19,656 (not counting books and travel and lodging expenses over the two years).

So far, I have invested nearly CAD 5,000 having taken 3 courses (including one on-campus session) and scored A+ in each! Praise God! That largely explains the gaping -$4,839.01 hole in my ministry account from which I serve the cause of international students globally and from which I get paid!

THE ASK—A GIFT THAT KEEPS GIVING

The other half of this legacy project is to provide SEED to invest in other staff and international students towards their leadership development including setting up a Global Leadership Incubator and a Leadership Institute. The task unfinished is great and urgent!

I invite you to give to the President’s Scholarship for Leadership. If 17 people sign up to give CAD 100 monthly we’ll meet the full target in 24 months. You may also decide to sponsor me for a whole course (CAD 1,200). If you have access to a foundation or other scholarship scheme that can offer grants of multiple thousands of dollars that will be awesome too. Please let me know.

Whatever you do, please make some contribution to the day of my birth and the birth of many multiple global leaders as a result–a gift that keeps giving towards the task unfinished.

Thank you for investing in hundreds of thousands of lives to begin and flourish before 40! Give HERE.

Pourquoi ai-je acheté une maison avant même d’acheter une télé ?

Puisque le voyage pour l’indépendance financière prendra plus de temps que vous ne le pensiez et sera plus difficile que vous ne l’imaginiez, le moins que vous puissiez faire est de «définir vos priorités», pendant cette Noël !

QUEL NOEL? PAPA NOEL!

Youpi, c’est encore Noël ! C’est l’une de ces fêtes d’anniversaire étranges où on ignore carrément celui est à l’honneur. Il est plus question des fêtards en lieu et place du concerné même de l’anniversaire.

L’une des raisons pour lesquelles il est plus question du Père Noel et non pas vraiment de Jésus-Christ, Dieu dans la chair né à Bethléem comme un bébé – c’est que «Noël est généralement une haute saison de vente pour les commerçants dans de nombreux pays du monde. Les ventes augmentent considérablement au fur et à mesure que les gens achètent des cadeaux, des décorations et des provisions pour célébrer la fête». Aux États-Unis, par exemple, on estime qu’un quart de toutes les dépenses personnelles se font pendant la période de Noël.

Le secteur du commerce en détail des États-Unis a généré plus de trois milliards de dollars américains pendant les congés de Noel en 2013. La valeur des aliments et des boissons achetés par les grands détaillants au Canada en décembre 2014 était de 4,6 milliards de dollars.

UNE CONFESSION

Voyons Noël 2014. La valeur des téléviseurs et du matériel audiovisuel achetés chez les grands détaillants au Canada en décembre s’est élevée à 543,2 millions de dollars! Sachez-le, je ne suis pas un grand fan de télévision ou d’écran géant. De toute ma vie, jusqu’à il y a à peine trois ans, je n’avais jamais acheté de télévision. Avant cela, chaque télévision en notre possession dans ma maison conjugale nous avait été offerte. Chose intéressante, pour moi, concernant les premiers téléviseurs que nous avons achetés avec notre propre argent, c’est que lorsque nous avons acheté notre maison en 2013, nous y avons trouvé deux téléviseurs écran plat installés dans la maison. D’ailleurs, c’était la deuxième maison que nous venions d’acheter dans deux différents pays.

UN CREDO

Pourquoi cet ordre? Ceux parmi vous qui me connaissez bien sont conscients du fait que depuis 15 ans, je recherche de la Financial Whizzdom (l’art des finances). L’un des premiers principes que j’ai pris de l’auteur de Père Riche Père Pauvre, Robert Kiyosaki, est le fait d’acheter d’abord des actifs (quelque chose qui met de l’argent dans votre poche) avant d’aller vers les passifs (quelque chose qui sort de l’argent de votre poche).

J’aime la façon dont Kiyosaki clarifie cela pour ceux qui veulent polémiquer sur cette «définition» de l’actif et du passif: «si vous arrêtiez de travailler aujourd’hui, vos actifs vont vous nourrir; vos passifs vont vous bouffer». Est-ce plus clair? Les deux biens immobiliers que je viens de mentionner mettaient de l’argent dans nos poches d’une manière ou d’une autre. Et les téléviseurs? Bon…

Il y a eu des moments où je n’ai pas respecté mon credo, mais c’était important d’avoir à l’esprit et la discipline de produire d’abord des actifs et les passifs plus tard par rapport au fait d’avoir une télévision, du moins à mon avis. Définir ses priorités.

Parfois, je regarde avec une stupéfaction totale les jeunes possédants des passifs somptueux, surtout quand c’est un double passif en ce sens qu’ils achètent aussi ces objets à crédit!

LE NOËL DE DEMAIN!

Si jamais vous avez l’intention d’être financièrement indépendant – avoir un revenu passif n’excédant pas vos frais de subsistance de sorte que nous n’ayez pas à travailler toute votre vie – je vous assure qu’il vous faudra plus de temps que vous ne l’imaginer et cela vous coûtera plus que vous ne le pensez. Croyez-moi, cela fait plus de 15 ans que je suis dans cette aventure ; je sais de quoi je parle. Après plusieurs entreprises et de nombreux investissements dans plusieurs pays, je suis encore sur le chemin. Je n’y suis pas encore arrivé. Si vous vous serrez un peu la ceinture pendant cette Noël et celles à venir, vous obtiendrez sûrement des ressources de vos actifs pour vous nourrir et vous faire plaisir … pour la vie!

Je n’ai pas l’intention d’être un rabat-joie de la Noël. Je ne suis pas non plus partisan des mouvements Noel Sans Achats ou N’Achetez Rien. Tout ce que je dis, c’est qu’il faut fêter Noël d’une manière qui vous permettra de profiter d’autant de Noëls que le Seigneur vous permettra de vivre en bonne santé fiscale et physique.

Ma famille et moi allons profiter de Noël, donner et recevoir des cadeaux. Cette carte de Noël au début de mon article a été envoyée à nos clients et investisseurs par l’une de nos entreprises familiales, Adeshe Real Estate. Nous sommes sûrs de profiter et de partager Noël … mais en ayant aussi l’avenir à l’esprit. Au moment même où je suis en train d’écrire cet article, j’ai passé une grande partie de cette semaine à être un père au foyer parce que ma chère femme est absente. Elle est aux États-Unis pour conclure quelques marchés immobiliers.

Lorsque j’étais conseiller financier agréé à Investors Group il y a quelques années avec seulement environ un million de dollars en actifs à gérer à l’époque, c’était ahurissant pour moi de voir à la fin qu’il y avait autant de familles avec «plus de mois que d’argent.» Pourtant cette Noel, ‘tout le monde’ va dépenser comme s’il n’y aurait pas de lendemain. Vous ne souhaitez pas qu’à la fin vous vous retrouviez avec plus de vie que d’argent! Alors Définissez vos priorités. Joyeux Noël!

Translation: Timothée Zana Ouattara

Why I bought a house before ever buying a TV

Since the journey to financial freedom will take you longer than you think and be tougher than you envisage the least you could do is to put ‘first things first,’ even this Christmas!

WHAT CHRISTMAS? CLAUSMAS!

Yay it’s Christmas again! It’s one of those strange birthday parties where the birthday celebrant is largely ignored; it’s more about the partiers than the birthday bloke.

One reason why it’s more like SantaClausmas—than really about Jesus Christ, God-in-flesh born as a baby in Bethlehem—is because “Christmas is typically a peak selling season for retailers in many nations around the world. Sales increase dramatically as people purchase gifts, decorations, and supplies to celebrate.” In the U.S. , for example, it has been calculated that a quarter of all personal spending takes place during the Christmas shopping season.

The United States’ retail industry generated over three trillion U.S. dollars during the holidays in 2013. The value of food and beverages alone purchased at large retailers in Canada in December 2014 was $4.6 billion.

CONFESSION

Consider Christmas 2014. The value of televisions and audio and video equipment purchased at large retailers in Canada that December alone amounted to $543.2 million! Granted; I’m not a big television or silver screen fan. I never bought a television in my entire life until only about three years ago. Prior to that, every television we had owned in my marital home had been a gift. The cool thing, for me, about the first television sets we bought with our own money is that we got two flat screen TVs installed in a house we bought in 2013. That, by the way, was the second house we had purchased in two different countries.

CREED

Why this order? Those of you who know me well are aware that for the past 15 years I’ve been on a quest for Financial Whizzdom. One of the early principles I picked up from Rich Dad Poor Dad author, Robert Kiyosaki, was to first buy assets (something that puts money in your pocket) before going after liabilities (something that takes money out of your pocket).

I love the way Kiyosaki clarifies this for those who want to get argumentative about this ‘definition’ of assets and liabilities: “if you stopped working today your assets will feed you; your liabilities will eat you.” Clearer? Both real estate properties I just mentioned were putting money into our pockets in a variety of ways. And the televisions? Well…

There have been times when I’ve contravened my creed but it’s a good thing we had the mindset and discipline to do assets first and liabilities later when it came to getting a television, at least. First things first.

Sometimes I watch with utter amazement the lavish liabilities shown of by many young people, especially when it’s a double liability because these things have been bought on credit as well!

TOMORROW’S CHRISTMAS!

If you ever intend to be financially free—having passive income exceeding your living expenses thus not having to work at a job all your life—I can assure you that it will take longer than you envisage and will cost you more than you think. Trust me, I’ve been on this journey for over 15 years; I know. After several companies and umpteen investments in multiple countries I’m still en route. I’m not there yet. If you squeeze yourself a little this Christmas and the next few ones, you could really have resources from your assets feeding you and fanning your fun… for life!

I don’t intend to be a Christmas killjoy. Neither am I an advocate for the Buy Nothing Christmas or Buy Nothing Day movements. All I’m saying is that spend this Christmas in a way that will enable you to enjoy as many Christmases as the Lord will allow you to see in great fiscal and physical health.

My family and I will be enjoying the Christmas, giving and receiving gifts. That Christmas card at the beginning of my article is one sent by one of our family’s companies, Adeshe Real Estate, to our clients and investors. We sure are enjoying and sharing Christmas… but with the future in mind as well. Even as I write this, I’m being a stay-at-home dad for much of this week while my dear wife is away in the U.S. closing a couple of real estate deals.

When I was a licensed financial advisor at Investors Group a few years ago with only about a million dollars in assets under management then, it amazed me how many families had “more month at the end of their money.” Yet this Christmas, ‘everyone’ will shop as if there was no tomorrow. You don’t want to have more life at the end of your money! Put first things first. Merry Christmas!